Students sit listening attentively, fingers poised on keyboards and pens pressed against paper in apprehension to take detailed notes on what the speakers of the Texas Capitol Journalism Conference have to say as they delve into details about school funding and the system of recapture.

Recapture, also known as Robin Hood, is a system that divides schools into two categories. The first category is the districts that must spread the wealth, and the second is those that need money. These categories are determined by the price of property taxes in the district. Currently, the Austin Independent School District is paying the most when it comes to recapture amounts in Texas.

“Recapture means that property rich districts like Austin, have to surrender money to the state from their property taxes,” worksite representative for Education Austin and Bowie English teacher Jake Morgan said. “The state then reallocates money to the property poorer districts in the state.”

Property taxes are the main contributor in deciding how much a district pays in recapture amounts. Property taxes are calculated by multiplying the property’s appraised value by the tax rate. The appraised value of a property is an estimate of the attributes worth at a specific point in time. Tax rate is the ratio at which people are taxed and it differs depending on where homeowners live and the local taxing authorities.

“The property taxes that we pay in Austin, which are high because of the property values, fund our education system,” Morgan said. “Places where property values aren’t so high they end up getting less money. So, recapture is kind of an effort to balance that.”

Since recapture is directly affected by property taxes this is negatively impacting certain districts. Districts with a lot of industry like hotels or oil rigs. These are high value properties and often times the surrounding homes do not reflect the wealth of the businesses.

“Some of the districts that pay the highest percentage in recapture are places that have a lot of petroleum extraction and petroleum refining,” AISD Trustee Lynn Boswell said. “Other places that pay a higher percentage are locations like Port Aransas. These places have a lot of vacation homes. Those are not communities where people have a lot of wealth. That wealth leaves the community and goes to industries like resorts and oil rigs, not to the people that go to schools.”

Recapture was created following a lawsuit. It was the Edgewood ISD v. Kirby case. This case was significant to recapture as it regarded school funding. According to texaspoltics.utexas.edu “the Mexican American Legal Defense and Educational Fund filed suit against commissioner of education William Kirby on May 23, 1984, in Travis County on behalf of the Edgewood Independent School District, San Antonio, citing discrimination against students in poor school districts.”

“Recapture was a system created after a lawsuit,” Boswell said. “It was created to help make sure that every district in the state had fair funding.” Before recapture districts were funded based on their local property wealth. Which does not always correlate to the wealth of the people in the community.”

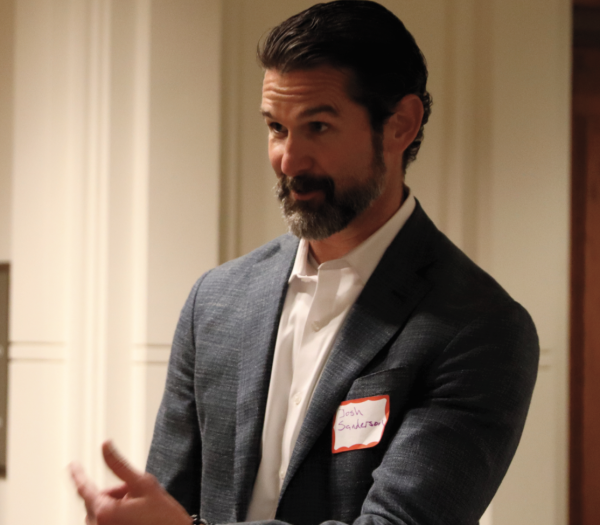

According to the Equity Center Executive Director Josh Sanderson stated that recapture does not affect district revenue. The Texas legislature decides what every school district’s funding will be each year. The recapture amount is then determined by the excess of revenue from property taxes.

“A school district is entitled by law to receive their funding every year,” Sanderson said. “The recapture that districts like Austin pay is funding that the district has locally in property tax revenue above what they are entitled to. That is why it is important to have the legislature increase school districts entitlements so that the school district can have more funding and the recapture amount goes down.”

Recapture began as just a way to fill some gaps in funding but has now grown into one of the major contributors to school funding. Recapture has become one of the biggest generators of revenue for the whole state and a lot of recapture is collected and has reducing the share of funding that is coming from state sources.

“Recapture was intended to make sure every school had adequate funding,” Boswell said. “What has happened instead is that we have gotten to a place where no school in Texas has enough. Because the state determines how much per student funding we have in our public schools, and they have chosen to fund us in the bottom 10 states nationally.”

This is impacting Austin schools because AISD pays the most when it comes to recapture amounts. This is driving up the prices of homes, businesses and goods and services.

“The local Austin community pays twice as much money to get the same amount of funding that everyone else has,” Boswell said. “We paid $698 million dollars in recapture this year. That is a lot of money and it is hard to wrap your head around. It doesn’t mean we have less money in our schools. We have the same amount of inadequate funding as every other district in the state, but what that does is make our housing more expensive, whether you buy or rent.”

Homeowners aren’t the only people who pay recapture in the form of property taxes. Businesses also contribute to that fund.

“HEB pays recapture, Whataburger pays recapture and when you go get gas, the gas station is paying recapture,” Boswell said. “When you go to the bank, when you get your car washed, when you buy dog food. All of these businesses are paying recapture. So, we are paying it for everything we do.”

AISD has proposed a tax ratification election called proposition A. This proposition will appear on voters on local ballots in November and asks voters if they want more funding for the district in the form of a tax increase.

“We are asking for a nine cent tax increase,” Boswell said. “That would be about $34 per month for the average homeowner. As our taxes go up, our recapture goes up, so the same time we bring more money into our schools we will also be increasing our recapture. Overall, right now we pay about 49% in recapture payments. If the tax ratification bill passes we would be paying about one percent in recapture.”

The district is also currently advocating for an increase in per student funding. When the per student funding goes up that will decrease the recapture amount.

“There is a legislative session coming up and we will be advocating with districts all over the state to increase that per student funding,” Boswell said. “If that funding goes up, that recapture will go down. We will also be asking the legislature to look at the impact of recapture on housing affordability.”

Schools have put procedures into place in an attempt to increase the per student funding. This is the amount of money given to the school based specifically on the attendance of its students. For example, Bowie has implemented the incentive program, which allows students who reach certain attendance standards to replace their grade on the final with their class average.

“We’re a big school,” junior Reed Watts said. “You can see the incentive program that was put in place to make sure people are attending, because the school needs money that they get from attendance.”

To combat the issues with recapture trustees, teachers, and advisors have advocated to the legislature for a change in how schools in the state of Texas are funded.

“I honestly think the main solution to how the issues with Texas’s recapture system can be solved is by reconfiguring the funding formula so we’re not losing almost a billion dollars per year,” Morgan said. “Most of all I encourage people to educate themselves on the issue and to advocate for a recapture system that is equitable and doesn’t leave urban and property rich districts suffering. I think kids deserve more than that.”